An Investment Opportunity That Offers Attractive Risk Adjusted Returns

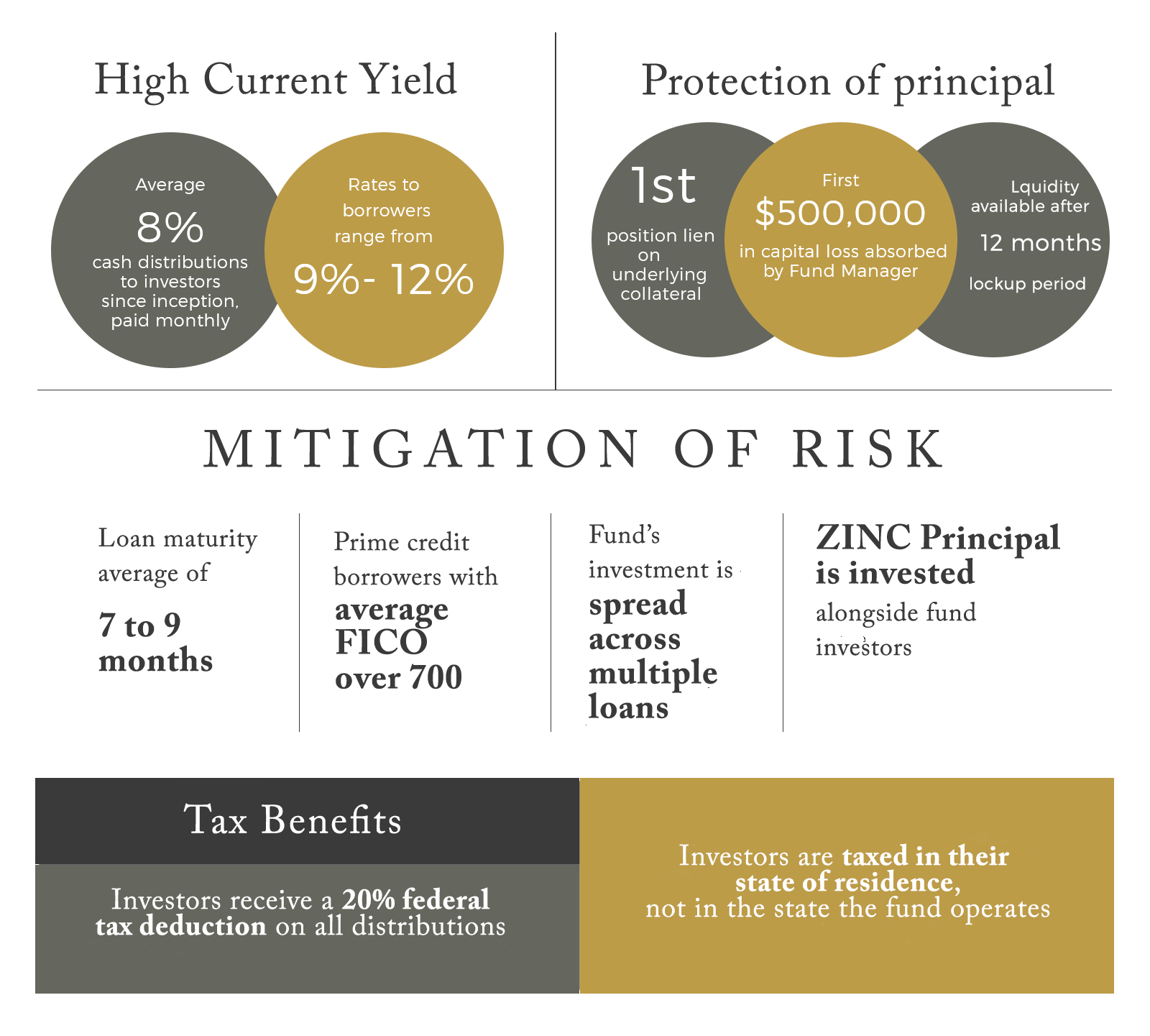

ZINC Income Fund specializes in business purpose fix and flip loans with the security of a perfected first lien position against the underlying collateral. The Fund’s objective is to provide monthly cash distributions and protection of principal.

ZINC Invests With You

We invest alongside you; our company principal is invested in the very same product that you are considering, creating a true alignment of interest. Our team of experienced real estate professionals are focused on delivering consistent returns in a stable asset class.